- Argyle Independent School District

- Argyle ISD Bond

- Tax Rate Update - March 22, 2022

Bond 2022

Page Navigation

-

Argyle ISD Bond

- Bond & Growth Planning Committee

- Voters Guide to Bond Election

- Bond Fact Sheet

- Voting Locations, Dates & Times

- Video: Frequently Asked Questions (FAQs)

- Frequently Asked Questions (FAQs)

- Bond Presentation

- Proposition A

- Proposition B

- Proposition C

- Bond Informational Video

- Tax Rate Update - March 22, 2022

- Notice of Election/Ballot

- Are You Registered to Vote?

- Community Bond Presentations

- Election Results

- Board Approves May 7 Bond Election

- 10-Year Strategic Growth Plan

- Elementary School #4

- Middle School #1

- Hilltop Elementary School Playground

- New Stadium at AHS - Canyon Falls

- Indoor Activity Center at AHS - Canyon Falls

- AISD Financial Accountability

- Demographic Reports

- AISD Growth

- Tax Information

- Contact Us

Argyle ISD Tax Rate Update

-

March 22, 2022

March 22, 2022

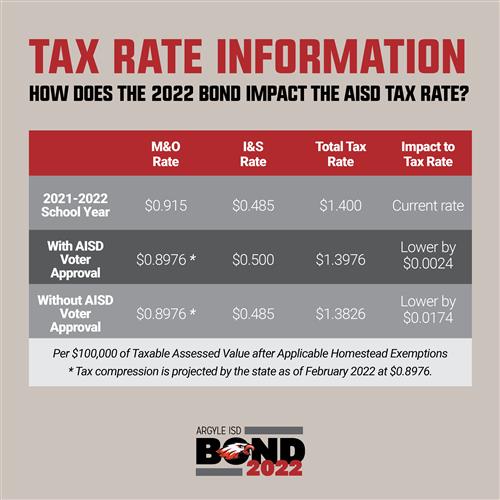

The Texas Education Agency recently released important school tax information related to House Bill 3 that will impact Argyle ISD families and the school district tax rate.Based on a tax compression formula released by TEA, Argyle ISD's Maintenance & Operations tax rate is scheduled to decrease in 2022-2023. This tax compression information was provided to the district in February, studied by the district's administration, and was presented to the Argyle ISD Board of Trustees during a regular meeting on Monday, March 21.

So how does this impact the Argyle ISD Bond Election on May 7? The overall tax rate will be lower next year, even if the bond passes. The M&O tax rate, with the compression by the state, is scheduled to drop from $0.915 to $0.8976. The Interest & Sinking (I&S) rate will increase to $0.500 if the bond passes. Due to the M&O rate compression, the overall tax rate impact to homeowners would be a decrease of $0.0024 if the bond passes.

This new tax impact information will be shared and explained during the Community Bond Presentations and updated on the Argyle ISD website. The first community presentation is tonight at 6:30 p.m. at the Harvest Hall Community Center, located at 1300 Homestead Way in the Harvest community. All Argyle ISD families and community members are welcome to attend. Click here to see the list of upcoming bond presentations.

House Bill 3 is a school finance bill passed by the 86th Texas Legislature in 2019 that reduces recapture and cuts local property taxes.