- Argyle Independent School District

- Tax Information

Bond 2022

Page Navigation

-

Argyle ISD Bond

- Bond & Growth Planning Committee

- Voters Guide to Bond Election

- Bond Fact Sheet

- Voting Locations, Dates & Times

- Video: Frequently Asked Questions (FAQs)

- Frequently Asked Questions (FAQs)

- Bond Presentation

- Proposition A

- Proposition B

- Proposition C

- Bond Informational Video

- Tax Rate Update - March 22, 2022

- Notice of Election/Ballot

- Are You Registered to Vote?

- Community Bond Presentations

- Election Results

- Board Approves May 7 Bond Election

- 10-Year Strategic Growth Plan

- Elementary School #4

- Middle School #1

- Hilltop Elementary School Playground

- New Stadium at AHS - Canyon Falls

- Indoor Activity Center at AHS - Canyon Falls

- AISD Financial Accountability

- Demographic Reports

- AISD Growth

- Tax Information

- Contact Us

Tax Information

-

ABOUT SCHOOL TAXES

Public school taxes involve two figures, which divide the school district budget into two “pots.” The first pot is the Maintenance and Operations budget (M&O), which funds daily costs and recurring or consumable expenditures such as teacher and staff salaries, supplies, food and utilities. Approximately 78% of the district’s M&O budget goes to teacher and staff salaries. The second pot is the Interest and Sinking Fund (I&S), also known as Debt Service, and that is used to repay debt for capital improvements approved by voters through bond elections.Proceeds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land and the purchase of capital items such as equipment, technology and transportation. By law, I&S funds cannot be used to pay M&O expenses, which means that voter-approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services.

TAX RATE UPDATE - MARCH 2022

The Texas Education Agency recently released important school tax information related to House Bill 3 that will impact Argyle ISD families and the school district tax rate.

Based on a tax compression formula released by TEA, Argyle ISD's Maintenance & Operations tax rate is scheduled to decrease in 2022-2023. This tax compression information was provided to the district in February, studied by the district's administration, and was presented to the Argyle ISD Board of Trustees during a regular meeting on Monday, March 21.

So how does this impact the Argyle ISD Bond Election on May 7? The overall tax rate will be lower next year, even if the bond passes. The M&O tax rate, with the compression by the state, is scheduled to drop from $0.915 to $0.8976. The Interest & Sinking (I&S) rate will increase to $0.500 if the bond passes. Due to the M&O rate compression, the overall tax rate impact to homeowners would be a decrease of $0.0024 if the bond passes. RESIDENTS OVER 65

RESIDENTS OVER 65

Argyle ISD property taxes for citizens age 65 or older would not be affected by the bond election as long as a homestead and over 65 exemption application have been filed with the local appraisal district.According to state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older cannot be increased above the amount paid in the first year after the person turned 65 regardless of changes in tax rate or property value unless improvements are made to the home.

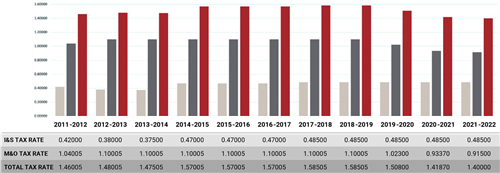

AISD TAX RATE HISTORY

Argyle ISD’s total tax rate has dropped each year since 2018, and it’s the lowest it has been in a decade.

The total tax rate may actually drop again in 2023, if the state continues to compress the Maintenance & Operations rate. However, the Interest & Sinking tax rate may increase 1.5 pennies if this proposition is approved by voters.

Why is my tax bill higher if the tax rate has gone down?

Even though the AISD tax rate is the lowest it has been in more than 10 years, your taxes are higher due to the overall property value growth, not the tax rate. Your home value is set by the Denton County Appraisal District, and when your home value increases, so does your bill.